This week in crypto was bonkers but most of the trad media was consumed by the midterms. While Arizona was counting votes, a Shakespearan farce unfolded (think Much Ado About Nothing, not Hamlet), mostly on Twitter.

So what happened? I’m breaking this up into a few sections: an introduction to the players, what happened, how my investments are faring, and whether or not this is funny.

The players

SBF - Crypto megastar who became a self-made billionaire in his 20s. Founded FTX, the 3rd largest crypto bank. Famous for being rich, smart, and reverse signaling, i.e. had messy hair and clothes so people thought he was extra smart. Also has very public, progressive values. Donated $50M to Democrats in these midterms, told everyone he wants to give away all of his wealth. Did lots of fancy conferences in the Bahamas, hung out with celebs, basically the main character of crypto over the past few years.

CZ - Another crypto megastar but less flashy. Founded Binance, the 1st largest crypto bank. Until very recently, a large investor in FTX.

FTX - #3 cryptocurrency bank and trading platform. Intense marketing budget - name on a stadium, did Super Bowl commercials, etc.

Alameda Research - SBF’s hedge fund that was supposedly completely separate from SBF’s bank, FTX

Binance - #1 cryptocurrency bank and trading platform

Sequoia Capital - behemoth venture capital firm in Silicon Valley. Been around since 1972 and was an early investor in Apple, Cisco, Google, Instagram, LinkedIn, PayPal, Reddit, Tumblr, WhatsApp, and Zoom.

What happened: a timeline

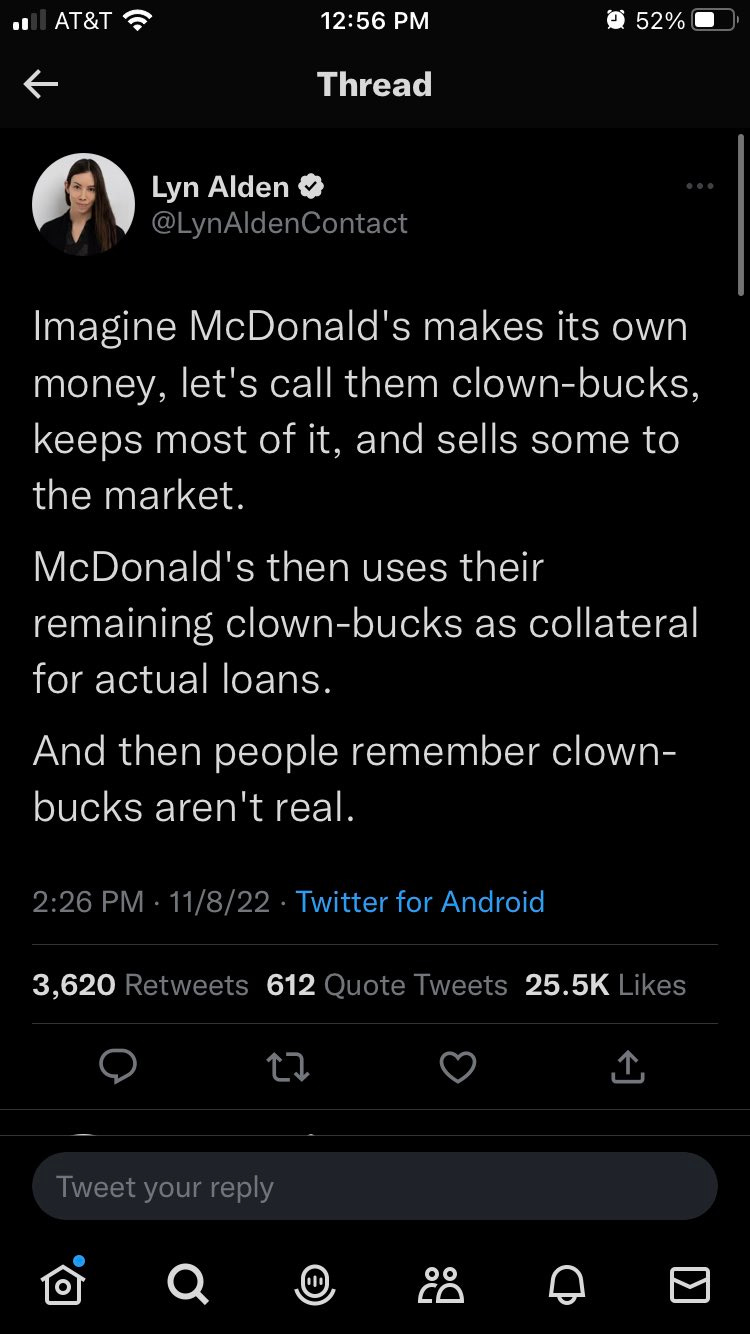

Alameda Research made some very risky bets. SBF funded those bets using customer’s money from FTX (over half of the $16B in customer deposits)

Alameda Research starts losing lots of money and their financials are leaked

CZ amplified the leak by publicly pulling all of his investment out of FTX

SBF says everything is FINE and no one has to worry about not being able to withdraw their money (this is a lie)

CZ pulling out of FTX causes a “run on the bank” for FTX

CZ realizes that FTX is insolvent and a large crypto bank going under due to insolvency is bad business for everyone in crypto, so CZ/Binance offers to buy FTX, subject to due diligence. At the time that this happened, though, people assumed CZ was the bad guy and that he spread rumors about his competitor so that he could buy them at a discount.

CZ does some preliminary due diligence and very quickly yeets out of the deal, Everyone starts to realize that actually, SBF is the bad guy

Sequoia Capital marks their $210M FTX investment down to $0

SBF says he’s super duper sorry

SEC announces an investigation into FTX

Justice Dept announces an investigation into FTX

Alternatively, this explanation:

How can I follow this as it continues to unfold?

Best source right now is Matt Levine (Bloomberg), who is really on top of this beat. Also turn on all tweet alerts for SBF (FTX), CZ (Binance), and Brian Armstrong, the CEO of Coinbase/adult in the room.

Are your investments okay?

There was a sharp drop in all crypto prices over the last few days but I’m still not near my all-time low, which shows some kind of decoupling between crypto bank panic and coin panic. This is good:

What about your bank? Is Coinbase okay?

Several months ago I chose Coinbase for my custodial wallet (aka crypto bank) and stayed away from FTX and Binance (Binance seems fine but I don’t totally understand their business model and that makes me uncomfortable). Coinbase is the most boring, by-the-book guy in the game and I love them for it. They hold 100% of their customer’s money at a 1:1 ratio and just make money off of trading fees. They actually offered margin trading at one time but shut it down in 2020. Crypto is already weird and risky so no one should be layering additional risk (margin trading, options, etc.) onto that.

What about your actual Coinbase investment, when you bought their stock?

COIN is in the toilet and probably will be for a long time. I still think they’re going to end up being one of the top banks and I believe I’ll recoup my investment in the medium term (another ~2 years). Coinbase is boring AF, keeps a low profile, and strives to preemptively achieve regulatory compliance. Still, I’m down 73% since my purchase on 4/1/22:

Is this funny? It seems kind of funny

It’s not funny for the FTX customers who are losing their shirts. It’s not funny for the FTX employees who will lose their jobs.

However, it is funny that SBF is the guy that was behind this staggeringly unethical (and illegal) racket because he’s positioned himself as a benevolent crypto genius who doesn’t really care about money and just wants the world to benefit from his vast intelligence. In reality, he was a Gen Z Bernie Madoff. I’m also hoping this will make the reverse signaling thing go away, i.e. if you yourself are sloppy maybe you’re just sloppy, and it’s not because you’re too smart to worry about haircuts or pants or whatever. Like, maybe the guy who sleeps in the conference room is just a guy who sleeps in the conference room.

It’s also funny because it has shown Sequoia Capital to be quite foolish but good on them for just coming out with it.